Figuring depreciation on rental property

The math gets more complex. Regarding basis for depreciation on rental property.

Rental Property Depreciation Rules Schedule Recapture

When you sell your home that you have lived in and owned for more than two years within the last five years you get to exclude.

. A straight-line depreciation method helps the owner determine the depreciation on the rental property. The building is depreciable over 275 years. For a married couple filing jointly with a taxable income of 280000 and capital gains of.

Depreciation expense Actual value of the property divided by 275 years. Calculate The Depreciation Schedule For Rental Property Things are not always straightforward. Calculating depreciation for rental properties involves determining the cash basis for the property separating the cost of the land from the building and then adjust the cost of.

IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use. If you own a 200000 rental property your depreciation expense would be. Generally we divide the cost of rental property with 275 years.

So if youre a millionaire your total capital gains taxes will be 333. All ordinary and necessary expenses paid or incurred during the tax year in maintaining the rental property are allowed as a deduction. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

For example if a new dishwasher was purchased for 600 had an estimated. Half of this we are using for personal use and half for. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertyÕs useful life.

On top of that California will charge another 1 to 133 when you sell. If your taxable income is 496600 or more the capital gains rate increases to 20. In our example letÕs use our existing.

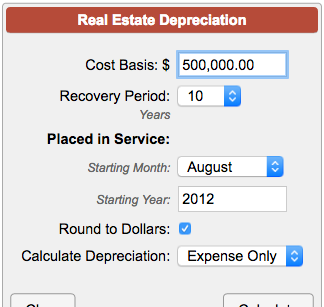

To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. Suppose we have duplex and its cost is 315000.

This is known as the. A real estate investor can claim a depreciation expense of 36 yearly. 325000 275 1181818 Therefore the depreciation is 1181818.

Rental Property Depreciation How It Works Mashvisor

Rental Property Depreciation Rules Schedule Recapture

Free Macrs Depreciation Calculator For Excel

Form 4562 Rental Property Depreciation And Amortization

Depreciation For Rental Property How To Calculate

Rental Property Depreciation Calculator Shop 60 Off Www Barribarcelona Com

How To Calculate Depreciation On A Rental Property

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

How Rental Property Depreciation Works The Benefits To You

Real Estate Depreciation Meaning Examples Calculations

Depreciation For Rental Property How To Calculate

How To Calculate Depreciation On Rental Property

14249 Schedule E Disposition Of Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

What You Need To Know About Rental Property Depreciation

How To Use Rental Property Depreciation To Your Advantage